Payment orders for ruble transactions

Viewing payment orders

The see previously created payment orders, select Ruble documents → Payment order.

To view a particular document, select it from the list.

The available actions for working with payment orders are described in the Operations with documents section.

Creating a payment order

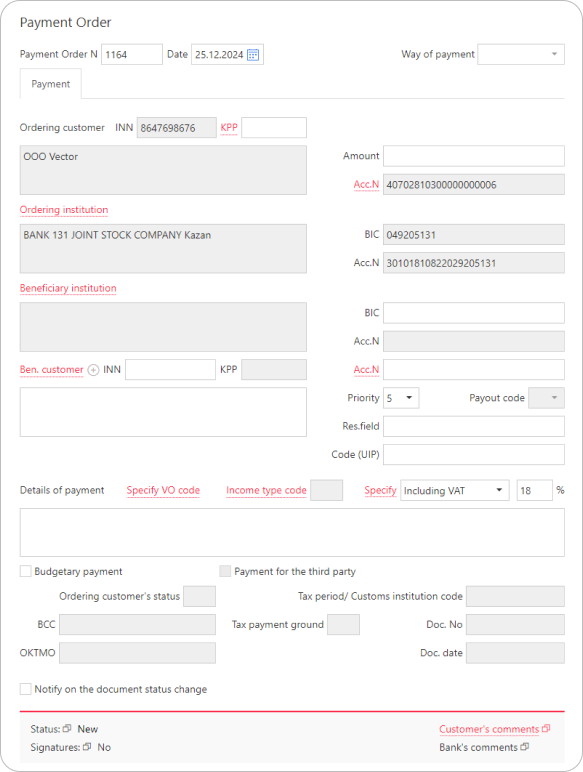

To create a payment order, fill in the fields of the Payment Order form:

-

The number and date of the payment order are filled automatically but can be edited if needed.

-

Optionally, fill in the Way of payment field.

-

The payer details are populated automatically with the information provided during registration.

-

In the Amount field, specify the payment amount (mandatory).

If when a payment order is signed, it appears that the daily or monthly limit is exceeded, a corresponding warning will appear.

-

Fill in the beneficiary institution details manually or use the Contractors directory.

The directory can be used to auto-fill the following fields:- Beneficiary's Tax ID (INN)

- Beneficiary's Tax Registration Code (KPP) (auto-filled if the recipient has no branches)

- Beneficiary's name

- Beneficiary's account

Beneficiary's account is auto-filled after specifying the INN if the recipient has only one account at the bank specified in Beneficiary institution; otherwise, select or input manually.

- Beneficiary's institution BIC (auto-filled after selecting the account)

-

In the Priority field, select the payment priority number.

-

Provide the Payment Identifier Code (UIP) (if assigned by the recipient) in the Code (UIP) field.

-

In the Details of payment field, specify the purpose of the payment (mandatory).

To select a foreign exchange operation code, click Specify VO code, and choose from the dialog.

The selected code will appear at the beginning of the Details of payment field in the format{VO<operation code>}. -

If the payment order is related to the payment of salary or any other income to the recipient, click the Income type code link and select a value from the dropdown list.

-

For VAT calculation, choose either Exempt VAT or Including VAT and click the Specify link. If VAT applies, specify the VAT rate in the corresponding field.

After that, the phrase Including VAT or the VAT amount calculated from the specified sum will appear in the Details of payment field. The VAT value can also be specified manually in the field. -

For payments to the Russian Federation's budget system, check the Budgetary payment box.

In this case:- The Code (UIP) field becomes mandatory. If not provided on the receipt, enter

0.

For payments to the Ministry of Internal Affairs or traffic police, include the resolution or UIN number. - If the payment is made on behalf of a third party, check the Payment for the third party box and fill in the third party's details: INN and KPP.

- Copy the remaining mandatory fields from the receipt.

Most tax, fee, and contribution payments to the budget are made as a Unified Tax Payment (UTP) to a Unified Tax Account (UTA).

More Details

- Use the following recipient details for unified tax payments (UTP) payments:

- BIC: 017003983

- Beneficiary institution: OTD TULA OF BANK OF RUSSIA//UFK for Tula Region, Tula

- INN: 7727406020

- KPP: 770801001

- Ben. customer: Federal Treasury Department for Tula Region (Interregional Tax Office for Debt Management)

- Beneficiary institution account number (EKS): 40102810445370000059

- Beneficiary account number (treasury account number): 03100643000000018500

- In the BCC field, use the special KBK for UTP: 18201061201010000510;

- In the Ordering customer's status field, select "01" from the dropdown menu.

- In the Details of payment field, enter "Unified tax payment".

- In the OKTMO field, specify an eight-digit OKTMO code or 0.

- In the Tax payment ground, Tax period, Doc. No, and Doc. date fields, enter 0.

- The Code (UIP) field becomes mandatory. If not provided on the receipt, enter