Document types and statuses

Document types

The service has the following document types:

Outgoing documents are financial documents created by the customer to instruct the Bank on certain actions according to the document.

Incoming documents are documents which the customer can receive from the Bank.

Statements are consolidated documents for bank accounts you can create.

Letters are messages between the Bank and the customer. These include Incoming letters addressed to the customer and Outgoing letters addressed to the Bank.

Reference books are directories that contain banks' and correspondent banks' details, currency codes, and other frequently used data. They make it easier to fill in document fields.

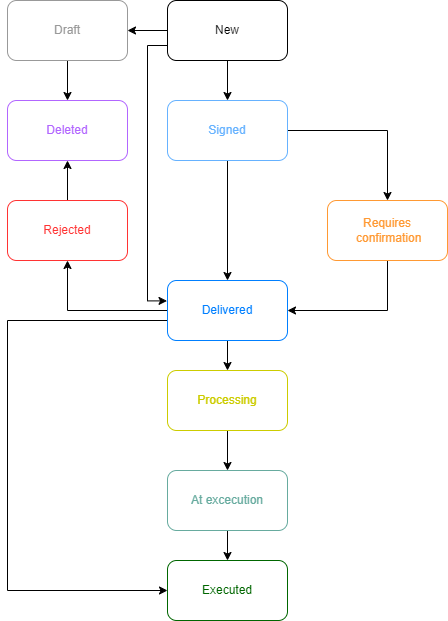

Outgoing document statuses

Document status reflects its processing status. A document can have the following statuses:

Draft: assigned when a new document is created and saved or when an imported document fails field validation. Once all errors are corrected and the document is saved, its status changes to New. Documents in the Draft status are not reviewed or processed by the Bank.

New: assigned when a new document is created and saved, an existing document is edited and saved, or a document is imported from a file. Documents in the New status are not reviewed or processed by the Bank.

Signed: assigned when a document is signed, but the number of signatures is not enough to send the document to the Bank. Once changes are made and the document is saved, its status changes to New.

Requires confirmation: assigned to payment orders signed with the required number of signatures as an additional protection measure. To send such documents to the Bank, the customer has to provide a confirmation code. The code can be generated using a BIFIT MAC token, a MAC token, an OTP token, or received via SMS to a phone number registered with the Bank.

Delivered: assigned to documents signed by all required signatures. The Delivered status instructs the Bank to start processing the document (execute or reject it).

Processing: assigned once the Bank accepts the document for processing.

At execution: assigned once the Bank accepts the document for execution.

Executed: assigned when the Bank executes the document and adds it to the accounting record. In the Settings section, you can adjust the number of days for which documents in the Executed status are displayed.

Rejected: assigned to documents not accepted for execution by the Bank. You can either edit and save such a document (its status will change to New) or delete it (the status will change to Deleted).

Deleted: assigned to documents deleted by the customer. Only documents in the following statuses can be deleted: Draft, New, Signed, or Rejected. Documents in the Draft, New, and Signed statuses will be deleted permanently. You can view documents deleted after rejection with the help of a filter. In the Settings section, you can adjust the number of days for which deleted documents are displayed.

Document status flow